TIAA & Retirement: Your Guide To Annuities & Savings

Are you prepared for the financial realities of retirement, or does the thought of it evoke a sense of uncertainty? Securing a steady stream of income in your golden years is not merely a desirable goal; it's a fundamental necessity, and understanding the pathways to achieve it is paramount.

The world of retirement planning can often feel complex, a labyrinth of options, regulations, and financial instruments. However, at its core, the objective is straightforward: to ensure a comfortable and sustainable lifestyle once you've transitioned from your working years. A crucial component of this is understanding how to generate and manage your retirement income.

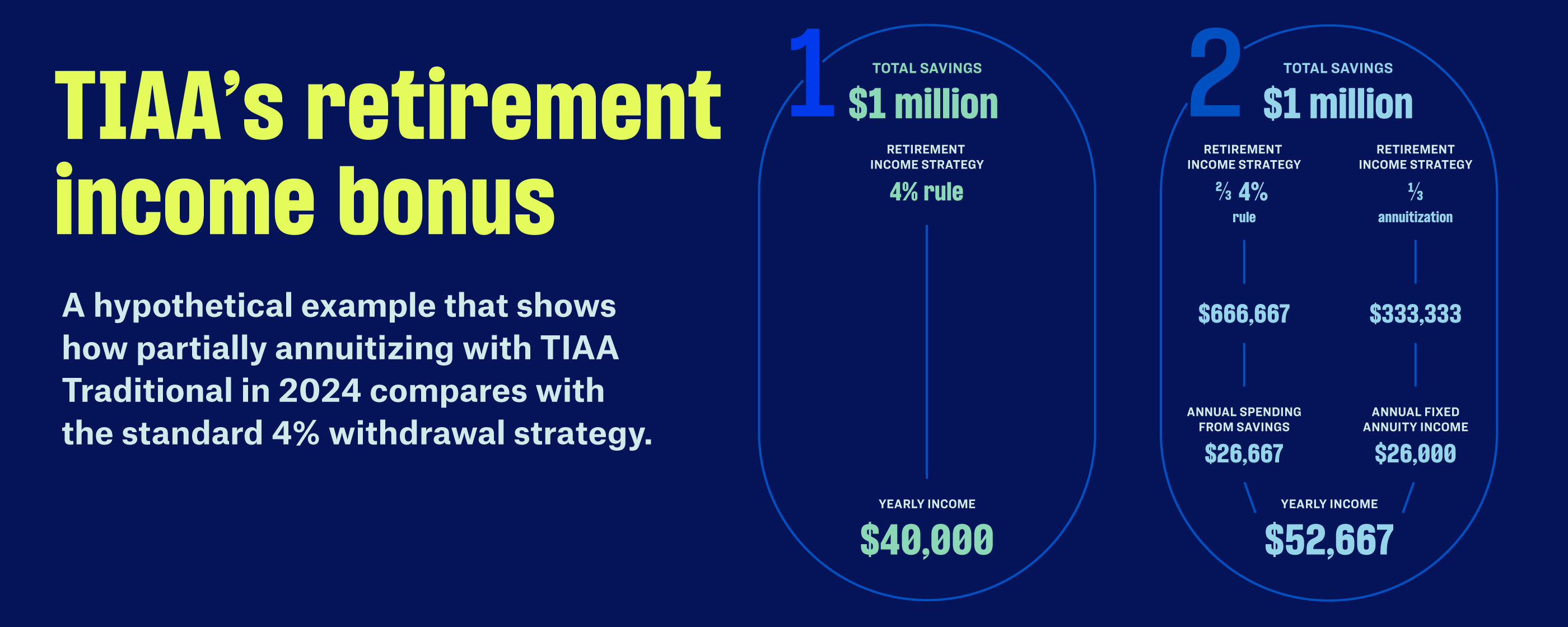

A retirement check, essentially the annuity income received during retirement, is the culmination of years of diligent saving and strategic planning. While various financial vehicles contribute to your retirement income, annuities, in particular, offer a unique proposition: a guaranteed stream of income that you cannot outlive. This guarantee provides a level of stability and predictability that other investment options may not.

As of December 31, 2024, the assets under management (AUM) across Nuveen Investments affiliates and TIAA investment management teams totaled a significant $1,387 billion. This impressive figure underscores the scale and scope of financial institutions like TIAA in the retirement landscape, reflecting their significant role in helping individuals and institutions plan for their financial futures.

For those looking to access TIAA products and services, the process begins with logging into your account. Whether using your user ID and password or a passkey, the goal is the same: to gain access to the tools and resources designed to help you manage your retirement savings effectively.

TIAA caters to a diverse clientele, offering retirement saving options tailored for individuals in various fields. These encompass employer plans, IRAs, and annuities, providing a flexible framework to accommodate a range of financial situations and retirement goals. Moreover, understanding the different options will help you navigate the choices you will need to make.

Beyond simply offering retirement plans, TIAA provides resources to empower its clients. Enrolling in a plan, accessing your account, and understanding how to secure lifetime income with TIAA are fundamental steps. Further support includes access to professional financial advice, the ability to set financial goals and savings targets, and the provision of valuable insights and ongoing support.

The TIAA Traditional Annuity stands out as a fixed annuity, distinguished by its guarantee of growth and the promise of lifetime income in retirement. With high financial strength ratings, it offers a dependable foundation for your retirement savings. Moreover, this fixed annuity can provide opportunities for additional financial gains through a profit-sharing arrangement.

The TIAA microsite serves as a comprehensive hub for managing your retirement account. It provides the means to oversee contributions, explore investment options, and connect with TIAA advisors for personalized guidance. This digital portal simplifies the complex task of retirement planning.

Online enrollment and the option to defer a portion of your salary into retirement plans are essential components of a well-structured retirement strategy. These features allow you to take control of your financial future and to adjust your contribution amounts as your circumstances evolve.

For those already invested, it is important to log in to your TIAA account regularly. Staying informed about your investments and actively managing your portfolio is vital. This proactive approach helps ensure that your retirement plan aligns with your current financial goals and circumstances.

TIAA may share profits with TIAA Traditional Annuity owners. This can take the form of declared additional amounts of interest during the accumulation phase, leading to a higher initial annuity income. It can also translate into further increases in annuity income benefits during retirement. However, it's crucial to understand that these additional amounts are not guaranteed and only apply to the period they were declared.

It's important to understand the limits of financial protection. The Securities Investor Protection Corporation (SIPC) primarily safeguards customers' securities and cash held in brokerage accounts, not necessarily all aspects of retirement plans or annuities.

Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America (TIAA) and College Retirement Equities Fund (CREF), both located in New York, NY. Each entity is solely responsible for its own financial condition and contractual obligations. This underscores the importance of understanding the financial stability of the institutions that provide your retirement products.

The origins of the retirement plan date back to July 1, 1929. This historical context provides perspective on the long-term commitment of organizations like TIAA to providing retirement solutions.

The retirement plan is designed for eligible employees of TIAA and its subsidiaries and affiliates. The adoption of this plan, with the necessary approvals, reflects a comprehensive approach to employee benefits, underlining the commitment of such organizations to their workforce.

For additional information, contacting TIAA directly is encouraged. Seeking expert advice is key to clarifying any concerns or questions about the retirement savings process.

The Teachers Insurance and Annuity Association (TIAA) is the designated recordkeeping service provider for retirement plan accounts. They maintain the records of your retirement contributions and investment performance.

To assist with questions related to retirement saving, TIAA offers free financial counseling. Taking advantage of such services can lead to more informed decisions about your financial future.

TIAA's services extend to UABs voluntary retirement programs, offering flexibility in how the total deposit is allocated. These options provide a tailored approach to retirement planning, aligning with the individuals needs and goals.

TIAA Traditional Annuity Group Supplemental Retirement Annuity (GSRA) provides detailed information for this option. It is essential to understand the various features of the plan.

The TIAA Traditional offers both guaranteed growth and dependable lifetime income, paired with exclusive benefits through the fixed annuity. This provides a secure and predictable source of income.

Understanding how to withdraw funds from your retirement accounts is a critical aspect of retirement planning. The steps you will need to follow should be clear and transparent.

Creating a retirement income plan is crucial in deciding the timing and manner of withdrawals from your retirement accounts. A well-structured plan helps you manage your finances and ensure you won't run out of money.

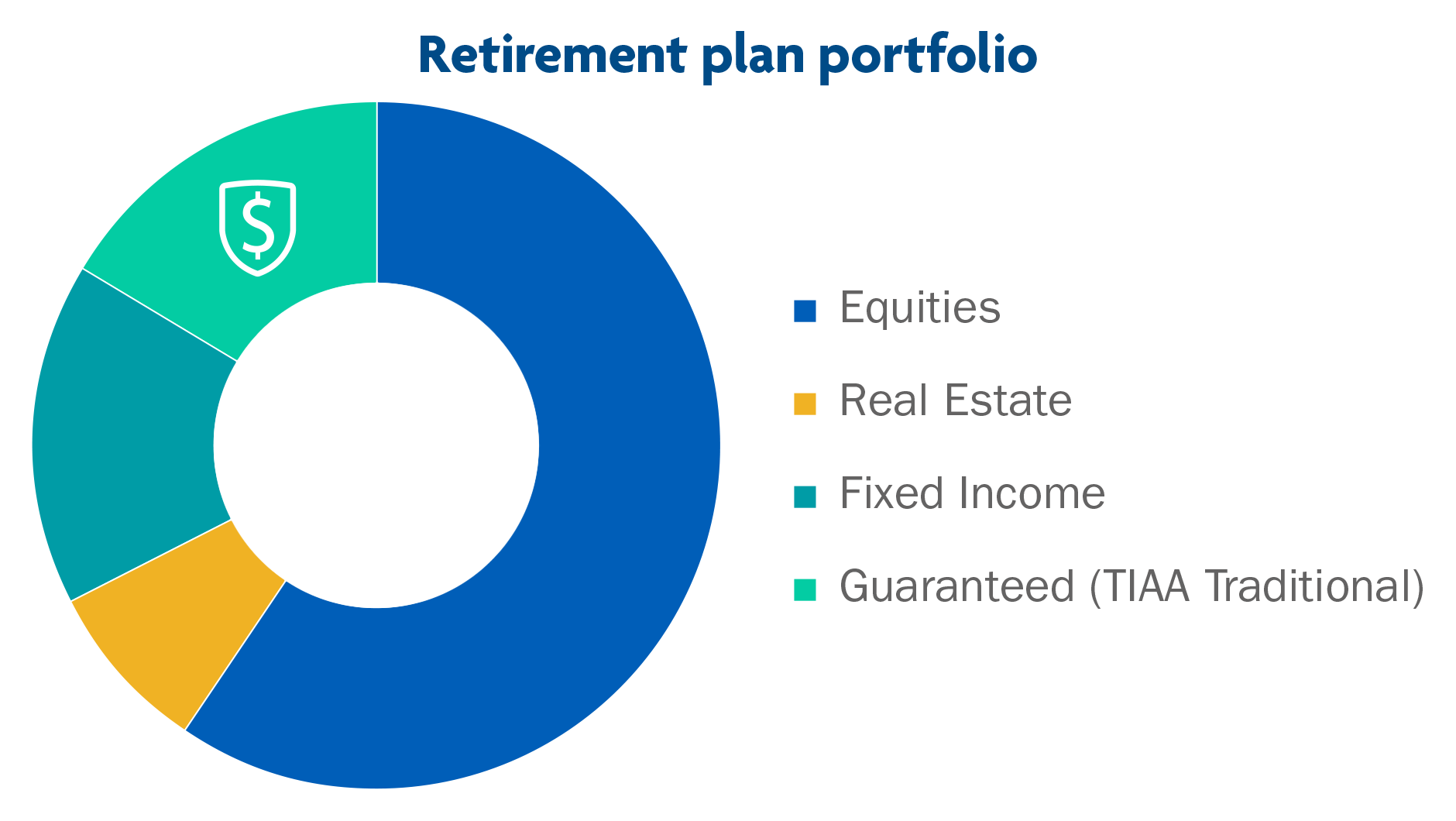

Knowing your account balances and the proportion of your retirement income in a guaranteed asset class can significantly influence your withdrawal strategy. This understanding will help you draw from your accounts at the appropriate times.

Even if your retirement plan does not permit cash distributions, there are often options to withdraw your entire retirement savings if your TIAA Traditional account value does not exceed $2,000, provided your overall account balance is within the limits defined by your employers plan (either $1,000 or $5,000). It is essential to understand the details of your specific plan.

TIAA Access is a unique retirement savings account that invests in underlying mutual funds, with the potential for income payments during retirement. While it is designed for investment during the working years, it also provides the option for lifetime income payouts during retirement. It is a balanced approach to financial planning.

The option to transfer or roll over funds from other employer plans to the TIAA retirement plan can increase your maximum loan amount. Before making any decisions, familiarize yourself with the terms and conditions.

It's important to know that TIAA does not offer loans on Roth accumulations in 403(b)/401(k) plans. Thoroughly understanding your plan's specific guidelines is important.

The information and resources offered by TIAA, particularly in the areas of retirement planning and investment management, are essential in helping individuals navigate the complexities of preparing for their financial future. As we have seen, their range of financial instruments and services are designed to cover a wide variety of needs and circumstances. By understanding the fundamentals, such as how to manage account access, the characteristics of specific products, and the importance of professional advice, individuals can confidently plan for and achieve their retirement goals.

The core message is this: comprehensive retirement planning requires diligent saving, strategic investment choices, and a well-defined income strategy. The services and resources offered by organizations like TIAA provide the tools and support necessary to make informed decisions, build financial security, and ultimately, enjoy a fulfilling retirement.